Finding the Best Short-Term Loan and Low-Interest Payday Loans in the UK

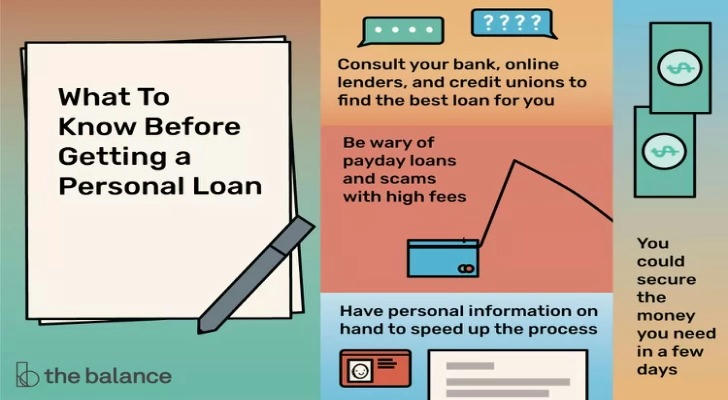

When financial emergencies arise, many people in the UK turn to short-term loans or payday loans to cover unexpected expenses. Whether it's an urgent car repair, medical bill, or any other short-term financial need, getting short-term loan pre-approval can be a quick and effective solution. However, it's essential to find low-interest payday loans to avoid excessive fees and ensure that repayments remain manageable.

Understanding Short-Term Loans and Their Benefits

A short-term loan is a borrowing option designed to be repaid within a short period, usually within a few months to a year. Unlike long-term loans, these are ideal for those who need a quick cash boost but don’t want to be locked into long repayment terms. Short-term lenders in the UK offer various flexible options, and many of them provide fast approval, especially for those with a steady income.

If you’re searching for short-term loan lenders, it’s important to compare the interest rates and repayment terms. Some lenders charge high fees, while others provide more competitive low-interest payday loans that make repayment easier.

Why Choose Low-Interest Payday Loans?

Payday loans have often been criticized for their high costs, but in recent years, many lenders have introduced pay day loan low interest options to make borrowing more affordable. The best low-interest pay day loans allow borrowers to access the money they need without getting trapped in a cycle of debt. These loans are particularly useful for those who need a small amount of money for a short period and can repay it with their next paycheck.

Finding the Right Short-Term Loan Lender

When looking for the best short-term loan lenders, it’s essential to check their terms and conditions. Some lenders specialize in credite online UK, which allows borrowers to apply online and receive funds within hours. These online lenders are convenient, fast, and often have fewer requirements than traditional banks.

For those who don’t own property, unsecured loans are a great option. An unsecured personal loan doesn’t require collateral, making it accessible to more people. However, the interest rates can sometimes be higher, so it’s crucial to compare different lenders.

Homeowner Loans and Secured Loan Options

If you’re a homeowner, you might qualify for homeowner loans, which typically come with lower interest rates due to the security of the property. This type of loan can be beneficial for home improvements, debt consolidation, or other significant expenses.

Another alternative for homeowners is a second charge mortgage. This allows you to borrow money using your home equity while keeping your existing mortgage. Many people use this option for large expenses, as the interest rates are often lower than traditional personal loans.

Remortgage Deals and Secured Loans

For those who already have a mortgage but want to reduce their monthly payments or access additional funds, remortgage deals can be an excellent choice. By switching to a new lender or negotiating better terms, you can lower your interest rate and save money in the long run.

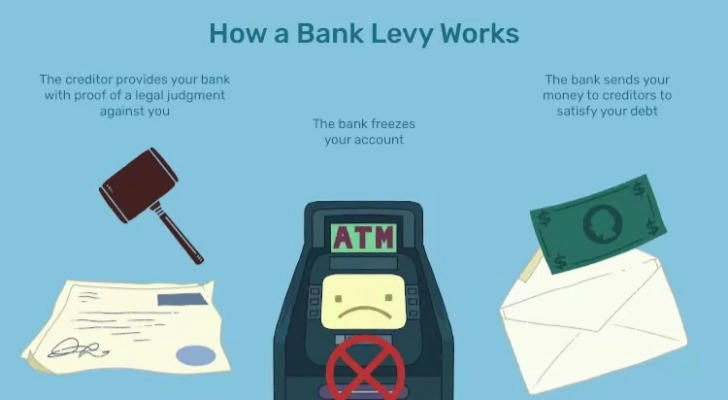

Financial expert Martin Lewis often discusses secured loans as an effective way to borrow larger amounts at lower rates. However, it’s important to consider the risks involved, as failing to repay a secured loan could lead to losing your home.

How to Get Approved for a Loan Quickly

If you’re in urgent need of cash, choosing a lender that offers short-term loan pre-approval can speed up the process. Many lenders in the UK provide instant decisions, allowing you to know whether you qualify before going through the full application. This saves time and increases your chances of getting the money you need without unnecessary delays.

Conclusion

Finding the right loan in the UK doesn’t have to be complicated. Whether you need short-term loans, unsecured personal loans, or homeowner loans, there are many options available. Always compare interest rates, repayment terms, and lender reputations before making a decision. With the right remortgage deals or low-interest payday loans, you can get the financial support you need without unnecessary stress.

If you’re ready to apply, start by checking your eligibility for short-term loan pre-approval and explore the best short-term lenders in the UK today.

Case Study 1: How a Short-Term Loan Helped a Freelancer in London

Background

George, a freelancer in London, faced an unexpected issue when his laptop broke down while he was working on an important project. Without a functional device, he risked losing a valuable client. Unfortunately, he did not have enough savings to buy a new one immediately.

Solution

After searching for “short-term loan pre-approval”, he found a lender offering “low-interest payday loans” with fast approval and same-day funding. He applied for the loan online, where the system provided an instant pre-approval decision.

Result

George received £800 within 30 minutes, allowing him to buy a new laptop and complete his project on time. The lender offered a lower interest rate compared to traditional payday loans, and he was able to repay the amount within a month without financial strain.

This example highlights the advantages of fast short-term loans, especially when unexpected expenses arise.

Case Study 2: How an Unsecured Personal Loan Helped a Homeowner Renovate Her Property

Background

Emily, a teacher in Birmingham, wanted to renovate her kitchen and bathroom. However, she didn't have enough savings and was hesitant to take out a loan that required her to use her home as collateral.

Solution

After researching different options, she applied for an "unsecured personal loan" from a trusted lender. She also compared "homeowner loans", "remortgage deals", and "Martin Lewis secured loans" to find the best rates.

Result

Within 48 hours, Emily received £15,000 with a competitive interest rate, allowing her to complete her home renovation without financial stress. She opted for a 36-month repayment plan with fixed monthly payments that fit her budget.

Her experience demonstrates how unsecured loans can provide a reliable and low-risk solution for homeowners looking for additional funds.