Plan Ahead and Ease the Burden: A 2025 Guide to Final Expense Insurance and Prepaid Cremation Plans

In the U.S., the average cost of a funeral now exceeds $7,800 — a sudden and heavy financial burden for families without prior planning. As a result, more households are turning to final expense insurance and the emerging option of prepaid cremation plans for comprehensive protection.

✅ What Is Final Expense Insurance and Why Are More People Choosing It?

Final expense insurance is a type of small whole life policy designed to cover end-of-life expenses such as:

- Funeral and cremation costs

- Medical bills and outstanding debts

- Basic legal and administrative fees

Its advantages include:

- 📌 Low application barriers, often no medical exam required

- 💵 Affordable premiums suitable for seniors on fixed incomes

- ⚡ Fast claims process to help families cover urgent costs

💡 Limitations of Traditional Final Expense Insurance

While final expense insurance provides cash coverage, many seniors overlook service execution challenges, such as:

- Rising funeral costs outpacing policy limits

- Family members making impulsive spending decisions during emotional times

- Lengthy claims processes delaying payout after expenses are incurred

🔄 Filling the Gap: The Rise of Prepaid Cremation Plans

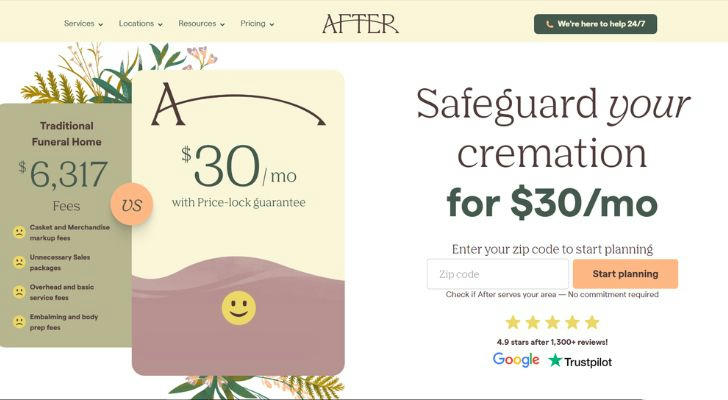

Prepaid cremation plans have gained popularity recently. For example, After.com’s offering highlights:

- ✅ Locked-in pricing to protect against inflation

- ✅ Flexible payment options, with monthly plans starting as low as $30

- ✅ Comprehensive services including transportation, cremation, and ash handling

- ✅ Simplified paperwork completed in advance to avoid delays

🧩 How Do These Two Products Work Together?

Final Expense Insurance ≈ Provides cash benefits

Prepaid Cremation Plans ≈ Ensures services are arranged and paid for

Combining both provides a balanced solution: families have funds available and services are guaranteed, reducing stress during difficult times.

✅ Recommendations for Seniors and Families

- If you are between 50 and 85 years old, review your current coverage

- Consider adding a prepaid cremation plan to complement cash benefits

- Prioritize plans with fast claims and transparent fees

Summary

In 2025, final expense coverage is evolving beyond simple cash policies. Locking in service prices and simplifying processes helps families avoid unexpected costs and delays.

📌 Learn more about prepaid cremation plans and how they can complement your insurance:

👉 After.com Prearrange Plans